the Companies Code, 2019 (ACT 992) of

the Republic of Ghana as a Nonprofit organisation.

integrity and accountability in the tax system particularly at the local and

national level to complement sub-regional and continental efforts to deliver tax justice.

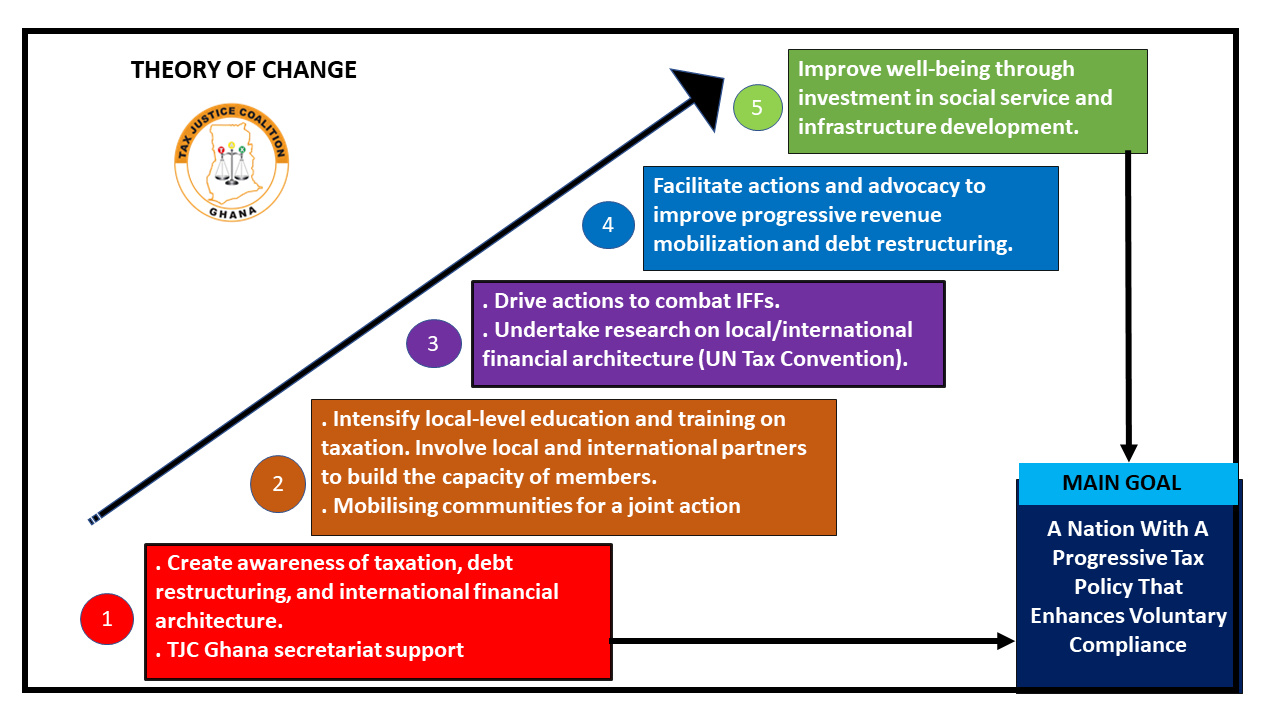

Theory of Change

Background

TJC Ghana, in pursuing its objectives finds it very necessary to develop this strategic plan as Ghana is in an economic crisis, and TJC Ghana needs this to be able to engage the government in the issues of tax justice. The strategic plan would not only guide the operations of the organisation but also ensure judicious and transparent use of resources. The Steering Committee (SC) therefore commissioned the secretariat to put it together.

Strategic Objectives

- To advocate for equitable and just tax policies

- To collaborate with Tax Justice Network – Africa and other allies on tax justice campaigns

- To build the capacity and create opportunities for members and stakeholders to analyse and monitor the implementation of tax and tax-related policies

- To assist Government in the mobilization of revenue through education and awareness creation

- To monitor and track Government budget allocations and fiscal spending on yearly bases

join the campaignMobilization

Budget Analysis and Economic Policies

We analyze local and national budget and review economic policies inperspective through our renowned experts and partners.

We monitor and hold government accountable on revenue mobilisation and expenditure.

Etc.

Education and Training

We educate our allies and the general public through in-person and virtual platforms on new development of taxation and economic justice. We provide training on specific economic issues to a targeted group for action.

Mobilization and Campaigns

We mobilize communities and grassroot efforts to take joint action on pressing taxes and economic issues. We join our local and international partners to participate in civil discourse and celebration days of action.

Eg. Stopthebleeding Campaign and Tackling IFFs

Conference and Forum

We organize local and international conferences and forum to bring experts at the table to discuss important issues affecting our economy and the repercussions on livelihoods. Through the consolidated efforts of our partners we organise workshops to build the capacity of our allies on the international financial architecture and new development.

Our Operational Policy

Our Operational Policies ensures that our steering committee, all staff, volunteers, consultants, vendors are guided and treated with the almost respect in the delivery of our work.

Support Us

The Tax Justice Coalition Ghana welcome all support, technical, volunteering, and financial to augment the advocacy work.

Contact us now!

Government and Agencies

We target the policy makers and implementers such us Parliament, Ministry of Finance, National Development Planning Commission, Customs and Ghana Revenue Authority and Etc.

Civil Society Organizations

We approach our strategy through the effective mobilization of our allies such as the Civil Society Organizations, Academia, Unions, Religious Bodies, PWDs, Grassroots and CBOs to ensure there is equity and equality in the merits of taxes, and development is fairly distributed.

Media

We work with the Media through out the campaign processes by building their capacity, give them contents and interviews to ensure results are achieved to the max.

International Non-Governmental Organizations

We work in solidarity and through the support of our Local and International Partners to address taxation, revenue and developmental challenges in the region.